The Future of Quantum Computing: Impact on Business

Table of Contents

Introduction

Picture this: a machine that doesn't just process data sequentially but explores an infinite web of possibilities all at once, much like how a seasoned strategist anticipates every outcome in a high-stakes negotiation. This isn't the realm of fantasy—it's quantum computing, and as we stand in January 2026, it's experiencing what scientists are calling its "transistor moment," akin to the pivotal shift that birthed modern electronics in the mid-20th century.

For business leaders, this means the potential to unravel complex problems that classical computers would churn over for eons—think optimising vast supply chains amid global disruptions or simulating molecular structures to fast-track life-saving drugs.

At its heart, quantum computing draws from the counterintuitive laws of quantum mechanics. Unlike classical bits, which are binary (0 or 1), qubits can exist in superposition—being in multiple states simultaneously. Add entanglement, where qubits link so that the state of one instantly influences another, regardless of distance, and you get exponential computational power. Interference allows these states to amplify correct answers while cancelling out errors, making quantum ideal for specific, intractable problems.

Why the buzz now? Breakthroughs in 2025 and early 2026 have propelled quantum from theoretical experiments to early practical applications. D-Wave's announcements at its Qubits 2026 conference highlight a 314% surge in usage of its Advantage2 systems, signalling growing commercial interest. Governments and corporations are investing billions, recognising quantum's role in economic competitiveness. According to projections, the quantum ecosystem could generate tens of billions in revenue by the mid-2030s, with early adopters capturing up to 90% of the value.

It's not about supplanting your everyday laptop; quantum augments classical computing for challenges like optimisation, simulation, and cryptography, potentially unlocking trillions in global economic value.

To grasp the difference: classical computers excel at linear tasks, like adding numbers or running spreadsheets. Quantum thrives on parallelism—solving puzzles with billions of variables, such as predicting climate patterns or cracking encryption. As Bernard Marr notes in his 2026 trends overview, the focus is shifting to "useful" quantum computing, where real-world applications emerge across industries. Yet, hype abounds; this article cuts through it, offering a grounded view for business decision-makers.

Current State of Quantum Computing

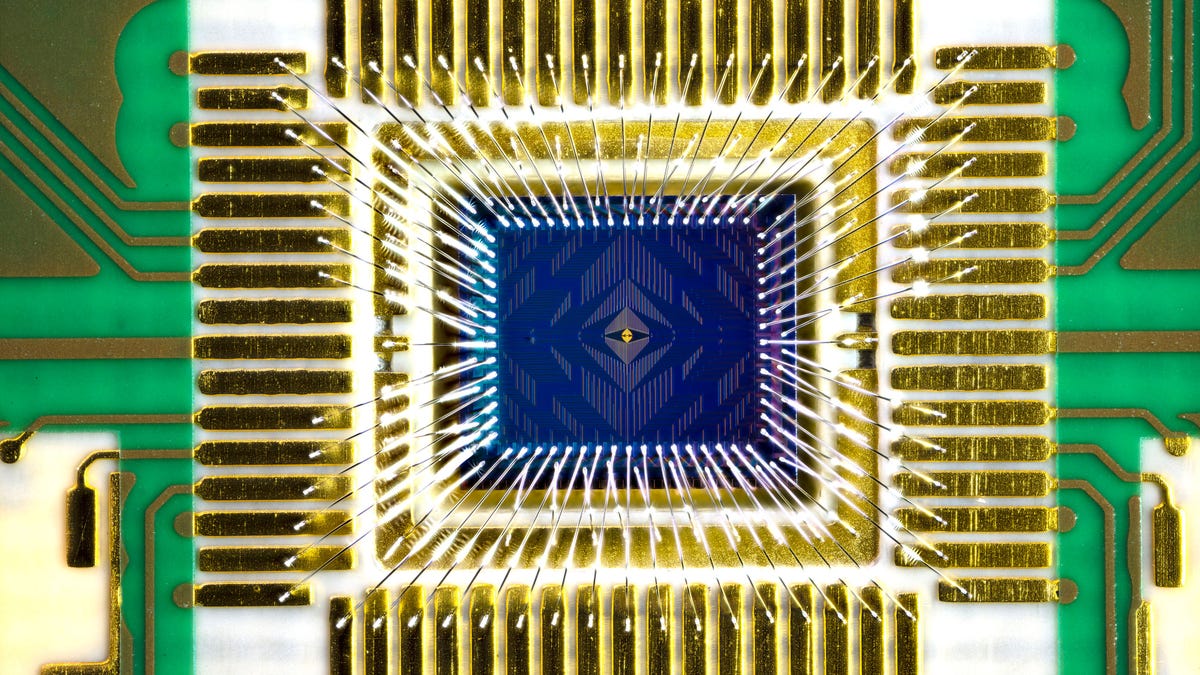

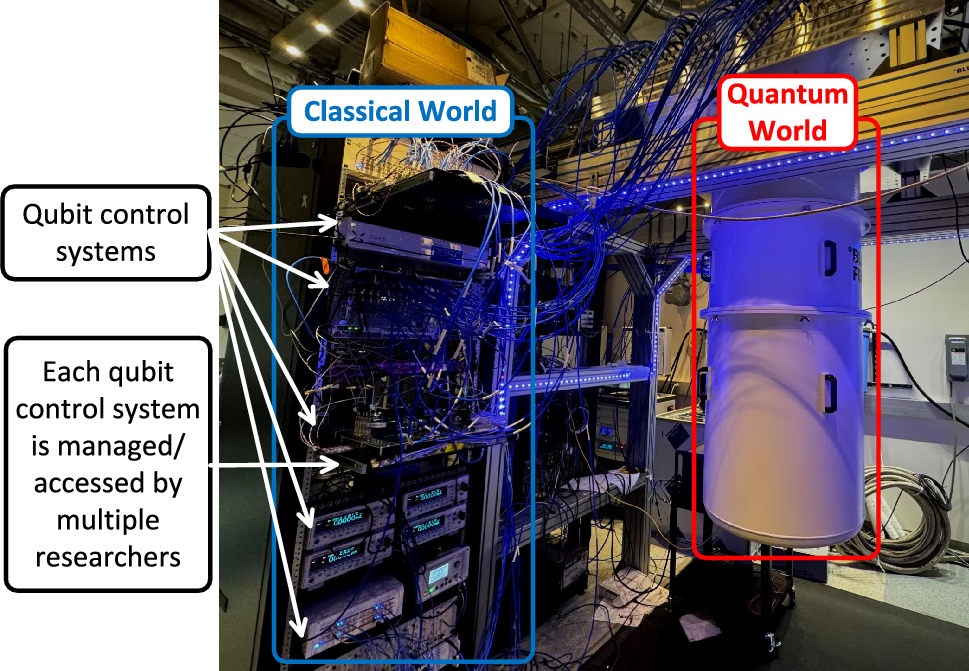

Quantum computing is no longer confined to academic labs—it's maturing into a viable technology, albeit with significant engineering challenges ahead. As of January 2026, systems feature hundreds to thousands of qubits, but the emphasis has pivoted from quantity to quality: fidelity, coherence times, and error correction. Qubits remain notoriously fragile, succumbing to decoherence from environmental noise, necessitating extreme conditions like near-absolute zero temperatures or advanced isolation techniques.

Progress is palpable. IBM's roadmap eyes error-corrected systems by 2029, building on its Condor processor with over 1,000 qubits. Google's Sycamore continues to push boundaries in supremacy demonstrations, while Microsoft's Azure Quantum integrates quantum with AI for hybrid solutions. D-Wave, a leader in annealing quantum computing, reported at Qubits 2026 an accelerated gate-model roadmap, including a breakthrough in scalable on-chip cryogenic control, with an initial gate-model system slated for later this year—bolstered by its acquisition of Quantum Circuits. Startups are innovating rapidly: IonQ boasts 99.99% gate fidelity in trapped-ion systems, QuEra delivers error-ready neutral-atom machines to Japan's AIST with global access planned for 2026, and Quandela highlights photonic trends like hybrid computing and early industrial pilots.

Neutral-atom approaches are gaining traction. Microsoft and Atom Computing aim for 50 logical qubits by early 2027 using 1,200 physical qubits, marking a leap in scalable error correction. Other modalities include superconducting qubits (IBM, Google), photonic (PsiQuantum, Xanadu), and silicon-spin (Intel, Oxford Ionics). ZenaTech is developing a five-qubit prototype for defense applications, expected operational by late 2026.

Governments are pivotal: The US has renewed its National Quantum Initiative, emphasising AI-quantum convergence and shared infrastructure. Europe, China, and Canada are building sovereign ecosystems; Canada projects quantum contributing $17.7 billion to GDP and 157,000 jobs by 2045. The ecosystem encompasses hardware (superconducting circuits, trapped ions, photons), software (Qiskit, Cirq, Ocean SDK), and Quantum-as-a-Service (QaaS) platforms like AWS Braket, Azure Quantum, and IBM Quantum Network, democratising access without owning hardware.

Limitations persist: Scalability to millions of qubits for fault-tolerant computing is a decade away, per experts. High energy demands, costs in hundreds of millions, and the "noisy intermediate-scale quantum" (NISQ) era's error rates hinder broad utility. As one analysis puts it, 2026 is about "hard engineering" over hype—focusing on machines that run reliably for hours, not just qubit counts. Market consolidation looms, with stronger players like D-Wave and IonQ scaling while others merge or falter.

How Quantum Computing Will Transform Business

Quantum's allure stems from conquering "NP-hard" problems—scenarios where solution spaces explode exponentially, overwhelming classical systems. Analogise it to finding the shortest path in a city with infinite roads: classical computers check one by one; quantum evaluates multitudes concurrently.

In optimisation, quantum algorithms like Quantum Approximate Optimisation Algorithm (QAOA) and Variational Quantum Eigensolver (VQE) shine. Logistics firms could dynamically reroute fleets, factoring in traffic, weather, and fuel—potentially slashing costs by 20-30% for giants like DHL or FedEx. Supply chain management evolves: during events like the 2021 Suez Canal blockage, quantum could simulate alternatives in minutes, minimising billions in losses.

Finance is a prime beneficiary. Risk modelling advances with quantum Monte Carlo simulations, forecasting market volatilities with granular precision amid uncertainties like inflation or geopolitics. Fraud detection leverages Grover's algorithm to search unsorted databases quadratically faster, identifying anomalies in transaction floods. Portfolio optimisation balances trillions of variables for maximised returns with minimised risks; JPMorgan Chase's pilots in option pricing demonstrate potential billions in efficiencies. Asset pricing and capital allocation could add $2-5 billion in operating income for banks by the decade's end.

Healthcare and pharmaceuticals: Quantum simulates molecular dynamics at atomic scales, impossible classically. Drug discovery accelerates—modelling protein folding or enzyme reactions could halve R&D timelines from 10-15 years, saving pharma billions. AstraZeneca and Pfizer's collaborations target repurposing drugs for diseases like Alzheimer's, while quantum aids personalised medicine by simulating individual genomes. In 2026, early use cases include small-molecule simulations, paving for breakthroughs in vaccines and therapies.

Manufacturing and materials science: Quantum predicts material properties without physical prototypes. Designing superconductors or advanced composites for aerospace—Boeing's explorations in aerodynamics could yield lighter, fuel-efficient aircraft. Battery chemistry simulations advance EVs, supporting sustainability goals.

Cybersecurity presents a paradox: Shor's algorithm threatens RSA encryption, enabling "harvest now, decrypt later" attacks. Yet, quantum inspires post-quantum cryptography (PQC) standards from NIST. Businesses must migrate by 2030-2035 to safeguard data; the World Economic Forum views this as an opportunity to modernise cybersecurity.

AI and machine learning: Quantum accelerates training on colossal datasets, enhancing neural networks. Quantum AI, a 2026 trend, could revolutionise predictive analytics, from customer segmentation to climate modelling. Hybrid quantum-classical setups process unstructured data faster, boosting efficiency in e-commerce or autonomous vehicles.

Beyond these, quantum aids climate change mitigation by simulating carbon capture or fusion reactions, and logistics in smart cities. The transformation is hybrid: quantum handles the heavy lifting, classical the rest.

Industry-Wise Business Impact

Quantum's integration varies by sector, with short-term hybrid pilots yielding incremental gains and long-term fault-tolerant systems driving revolutions. Projections estimate $450-850 billion in value creation by 2035, with finance, pharma, and chemicals leading.

Finance and banking: Short-term, quantum ML detects fraud in real-time, analysing patterns classical systems miss. HSBC's credit scoring experiments exemplify this. Long-term, real-time derivatives pricing and macroeconomic simulations could add trillions. Early adopters like JPMorgan are piloting for portfolio management, reducing risks in volatile markets.

Healthcare and pharmaceuticals: Short-term, simulate small molecules for drug repurposing, accelerating trials. Pfizer's quantum work could expedite vaccines, as seen in COVID responses. Long-term, full-protein and genome modelling personalises treatments, potentially curing rare diseases. R&D costs drop 50%, per BCG estimates.

Manufacturing: Short-term, optimise assembly lines, cutting waste 15-20%. Long-term, quantum-designed materials like stronger alloys transform automotive (e.g., Tesla's battery innovations) and aerospace.

Energy: Short-term, grid optimisation integrates renewables, balancing supply-demand. Long-term, simulate fusion or catalysts for hydrogen, aiding net-zero by 2050. Oil giants like ExxonMobil explore quantum for exploration efficiency.

Transportation and logistics: Quantum routes fleets optimally, reducing emissions 20%. Long-term, enables autonomous systems in smart cities, revolutionising urban mobility.

Chemicals and materials: BASF-like firms simulate reactions for green processes, speeding eco-innovations. Short-term pilots focus on catalysts; long-term disrupts with novel compounds.

Aerospace and defense: Quantum enhances simulations for aircraft design and secure communications. ZenaTech's prototypes target AI-driven defense analytics.

Short-term (next 5 years): NISQ hybrids for niches, per Marr's trends—optimisation in logistics, simulations in pharma. Long-term (10-15 years): Widespread as error-corrected quantum scales, reshaping supply chains and R&D. Deloitte's scenarios highlight four futures: rapid advantage in chemistry, delayed scalability, or hybrid dominance. Industries with HPC expertise, like finance, lead adoption.

Opportunities for Businesses

Quantum isn't merely a tool—it's a catalyst for reinvention, offering first-mover advantages reminiscent of the internet boom. Forward-thinking firms can forge new models, like quantum analytics services or simulation platforms, capturing shares in a market projected at $97 billion by 2035 and $21 billion for hardware by 2046.

Competitive edges abound: Accelerated R&D shortens time-to-market; hyper-personalisation tailors products via quantum ML; resilient operations weather disruptions. In pharma, faster pipelines secure patents; in finance, superior modelling boosts profits.

QaaS democratises access: Pay-per-use via clouds like AWS, Azure, or IBM lowers barriers for SMEs. No need for cryogenic setups—experiment remotely. Cloud giants compete on interfaces, making quantum the next battleground.

New ventures: Startups pivot to quantum software or sensors; enterprises form spin-offs. Investments surge—quantum funds target AI convergence. Partnerships with academia or governments, like the Quantum Economic Development Consortium, yield insights. Fujitsu predicts 2026 prioritises skills and ecosystems over hardware. Quantum AI hybrids open doors: Faster ML for e-commerce recommendations or predictive maintenance.

Globally, nations like Canada see quantum as economic infrastructure, fostering jobs and GDP growth. Businesses investing now position for 2030s dominance.

Challenges and Risks

Quantum's horizon is bright, but obstacles loom large. Technically, decoherence curtails qubit lifespans to microseconds; error rates demand redundancy—thousands of physical qubits per logical one. Scaling to fault-tolerant levels (millions of qubits) remains elusive, with NISQ limitations persisting.

Talent scarcity: Quantum demands interdisciplinary experts in physics, CS, and business—fewer than 10,000 globally. Skills gaps widen; upskilling via courses or hires is imperative, but competition is fierce.

Costs: Building systems exceeds $100 million, with cryogenic infrastructure adding more. ROI is uncertain pre-2030, deterring non-tech firms. Energy consumption rivals data centres, raising sustainability concerns.

Ethical and security risks: Quantum exacerbates inequalities if access skews to wealthy nations. Cryptography threats necessitate PQC migration; delays risk data breaches. Regulations lag—NIST standards help, but global harmonisation is needed. AI-quantum synergy could amplify adversarial threats, per security analyses.

Supply chains: Rare earths and fabrication bottlenecks delay progress. Hype risks bubbles—transparency is key to sustain investment. Geopolitical tensions: Export controls on quantum tech heighten, as seen in US-China dynamics.

Mitigation involves hybrid strategies, partnerships, and phased investments.

What Businesses Should Do Today

Procrastination isn't an option—quantum readiness starts now. Begin with audits: Identify pain points like optimisation bottlenecks or simulation needs. Map quantum's fit to strategy.

Skills development: Invest in training—online platforms like Coursera or IBM's Quantum Learning. Build cross-functional teams; hire specialists or consultants. Fujitsu emphasises quantum literacy for technical staff.

Pilot projects: Leverage QaaS for proofs-of-concept. Test supply chain optimisation or risk models. Collaborate with vendors like D-Wave or IonQ.

Long-term road-mapping: Integrate quantum into 5-15 year plans. Budget for hybrids; scenario-plan per Deloitte's futures. Join consortia for shared R&D.

Cyber prep: Inventory crypto assets; migrate to PQC by 2030. Monitor NIST guidelines.

Foster partnerships: With universities, startups, or governments for early access. Track investments—quantum jobs grow, per industry reports.

Future Outlook

2026 heralds quantum's practical pivot: Error correction advances, with QuEra, Microsoft, and Atom Computing delivering prototypes. Quandela's trends—hybrids, industrial cases, error correction, cybersecurity—define the year.

Next 5 years: NISQ hybrids for niches; useful applications in finance and pharma. 10-15 years: Fault-tolerant quantum reshapes industries, with quantum-centric supercomputers by 2033 and room-temperature qubits broadening access. Market hits $21B by 2046; $1T by 2035 in optimistic scenarios.

Global competition intensifies: US, China, EU lead, but collaboration via initiatives like NQI is crucial. Consolidation: Acquisitions rise; AI integration accelerates. Hype vs. reality: Focus on engineering yields sustainable progress.

Conclusion

Quantum computing stands poised to redefine business landscapes, from catalysing innovations in drug discovery and materials to bolstering cybersecurity and optimising global operations. In January 2026, with milestones like D-Wave's gate-model debut and neutral-atom error correction, it's transitioning from promise to practicality. Yet, it's no panacea—challenges in scalability, talent, and ethics demand prudent navigation.

For decision-makers, the call is unequivocal: Assess vulnerabilities, build capabilities, and experiment today to seize tomorrow's edges. Early movers could dominate, unlocking efficiencies and growth in a quantum-augmented world. As the transistor moment unfolds, those who act decisively will shape the future, turning quantum's potential into tangible, transformative impact.

Frequently Asked Questions (FAQs)

**Summary:** What is quantum computing in simple terms?Quantum computing uses principles of quantum mechanics—like superposition and entanglement—to process information using qubits, which can represent multiple states simultaneously, enabling it to solve certain complex problems much faster than classical computers.

**Summary:** When will quantum computing become commercially useful for businesses?Useful hybrid quantum-classical applications are emerging in 2026 for niche problems in optimisation and simulation. Broad, fault-tolerant quantum advantage is expected in the 2030s, with significant business impact projected between 2030-2040.

**Summary:** How does quantum computing threaten cybersecurity?Algorithms like Shor's could break widely used encryption (e.g., RSA) in the future. Businesses should prepare for "harvest now, decrypt later" risks by transitioning to post-quantum cryptography standards by 2030-2035.

**Summary:** What industries will benefit most from quantum computing?Finance (risk modelling, portfolio optimisation), pharmaceuticals (drug discovery, molecular simulation), logistics/supply chain (optimisation), materials science, and AI/machine learning acceleration are poised for the greatest impact.

**Summary:** Do businesses need to own quantum hardware to use it?No—Quantum-as-a-Service (QaaS) platforms from AWS, Microsoft Azure, IBM, and others allow cloud-based access, enabling experimentation without massive upfront investment.

**Summary:** What should businesses do to prepare for quantum computing today?Conduct readiness assessments, invest in skills/training, run pilot projects via QaaS, roadmap integration into long-term strategy, and prepare cryptography migration plans.